Patexia Insight 178: Companies with Major Patent Growth or Decline in 2022

In March, our fifth annual Patent Prosecution Intelligence Report was released, providing comprehensive coverage of the patent prosecution landscape over a five-year span, from January 1, 2018, to December 31, 2022. The report delves into the intricacies of patent prosecution, offering a wealth of statistical insights. The data presented in the report encompasses a wide range of areas, including filings, issuance, examination times, and analysis of both foreign and domestic activity among others. Through a meticulous approach, we have identified and analyzed all stakeholders involved in the patent process, including companies, law firms and attorneys. We have ranked them by activity and performance in three categories: overall, high-tech, and biotech.

Over the past few weeks, our coverage in Patexia Insights has included an in-depth analysis of various highlights from our recent report. In Patexia 173, we explored the countries that experienced significant growth or decline in patents issued by the USPTO, shedding light on the changing dynamics of foreign entities' patent activity. Turning our attention to the United States, Patexia 174 examined the patenting activities of the top states, providing insights into the regions that are leading in terms of patent issuance. In Patexia 172, we delved into the emerging trends in issued patents, offering valuable insights into the evolving landscape of patent innovation. In addition to these topics, we have also focused on companies in the patent ecosystem. In Patexia 175, we have published rankings of top companies based on their activity and performance. This week we will spotlight the companies that experienced the largest growth or decline in 2022 compared to the number of patents they were issued in 2021.

During the period of our study, the USPTO issued 1,846,457 patents and published 2,014,904 applications. We have evaluated 130,458 entities that have applied for and received patents in the United States, including both foreign and domestic applicants. In order to determine which companies experienced the largest growth or decline, a comparison was made between utility and reissued patents issued in 2022 and those issued in 2021, for the top 2,000 companies in terms of activity. Last year has proven to be a year of significant change and flux for many companies. While some have experienced tremendous growth in their patent portfolios, others have seen a decline. The bar chart presented below shows the top five companies that experienced the largest decline in 2022:

- IBM was the company that experienced the biggest decline with 47.19% fewer patents issued in 2022 when compared to 2021 which translates to 4,237 fewer patents. They have been the leader and the most active company in patenting for almost three decades, but a shift in their strategy caused them to lose first place to Samsung. This is attributed to IBM's transformation into a hybrid cloud and AI company. While they continue to maintain a strong patent portfolio, their approach to patenting has become more selective. The company has redirected its resources and talent towards making high-quality advancements in specific areas such as hybrid cloud, data and AI, automation, security, semiconductors, and quantum computing.

- Microsoft was second with a 23.35% decline when compared to 2021 which equals to 590 fewer patents issued. Although it’s possible that external factors may have influenced this recent drop, it’s worth noting that the number of patents issued has been falling since 2019. This and the fact that their research and development (R&D) expenditures have consistently increased over the past decade, suggest that they are prioritizing quality and the impact of their advancements rather than focusing solely on numerical figures.

- In 2022, Advanced New Technologies Co., Ltd. experienced a notable decline in the number of patents issued, marking a significant shift from their impressive patent growth in previous years. The company saw a decrease of 486 patents, reflecting a decrease of 54% compared to the previous year. It’s worth noting that this company had less than 20 patents issued before 2019, and had two years of consecutive growth in 2020 and 2021 before experiencing this decline.

- Ford often makes headlines when their patent applications get published revealing innovation and advancements in the car manufacturing industry. However, in 2022 they filed 434 fewer patents than in 2021, a decline of 23%. Their R&D expenditures have been stable during the past five years, fluctuating between $7.1 and $8.2 billion.

- Intel received 362 fewer patents in 2022, representing a decline of 12.51%. Similarly as Microsoft, they have increased the R&D budget during the past decade peaking at $17.53 billion in 2022. This suggests that they might be focusing on the quality of their patens rather than the quantity. It’s also worth mentioning that four out of five top declining companies are American, which suggests a potential trend within the domestic filers. The reasons for this trend belong to the realm of speculation but could be attributed to various factors such as shifts in research and development priorities, changes in business strategies, and evolving market dynamics.

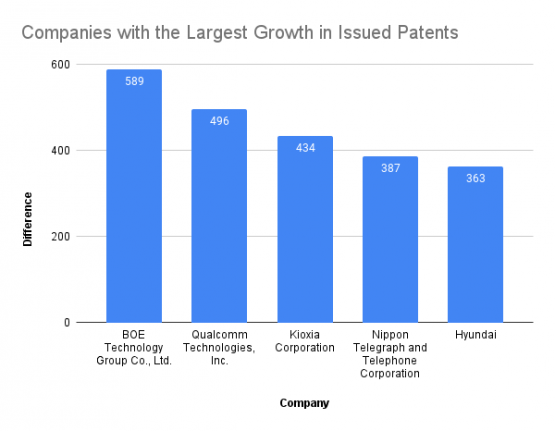

While 2022 witnessed a decline in patent filings for some companies, several others experienced significant growth in terms of issued patents when compared to their numbers in 2021. This indicates a contrasting trend among different companies within the industry. Below is a chart showcasing the top five companies that demonstrated largest growth in patents issued during 2022:

- BOE Technology Group Co., Ltd is the company that grew the most in terms of issued patents with 589 more than in 2022, or a growth of 27.40%. BOE is a Chinese company that specializes in the development, production, and sale of display products and solutions. Founded in 1993 and headquartered in Beijing, China, BOE has become one of the world's leading suppliers of display panels. With a focus on innovation, BOE has been actively involved in research and development, consistently filing patents for new technologies and advancements in the display industry. Nath Goldberg & Meyer, Ladas & Parry, and Calfee, Halter & Griswold are the top three law firms with which they work the most for their patent prosecution.

- Qualcomm ranks second with 496 more patents in 2022, representing a 23.06% increase compared to the previous year. Their growth can be attributed to several factors. Being in the highly competitive semiconductor and telecommunications industry, Qualcomm recognizes the importance of protecting its intellectual property and staying ahead of the competition. Furthermore, this particular industry is continually evolving, especially with the rapid advancements in wireless communication and mobile technologies. The filing of patents is a natural outcome of their ongoing research efforts, as they seek to protect and monetize their inventions. Lastly, Qualcomm's patent portfolio serves as a valuable asset for licensing and generating revenue. Holland & Hart and Patterson + Sheridan are their primary law firms for patent prosecution.

- Kioxia Corporation is a Japanese multinational corporation that specializes in the development and manufacture of flash memory products, including NAND flash memory and solid-state drives (SSDs). The company was spun off from the Toshiba conglomerate as Toshiba Memory Corporation in June 2018. Their patent numbers are on the rise with 434 more in 2022, a 250.87% growth. Similarly as in the case of Qualcomm, as a technology-driven company, Kioxia is constantly involved in research and development activities to drive innovation in the field of flash memory products. They have worked closely with Oblon, McClelland, Maier & Neustadt, Kim & Stewart LLP, and Foley & Lardner LLP for securing their patents.

- Nippon Telegraph and Telephone Corporation is a telecommunications company based in Japan. They have a strong focus on innovation and are known for their significant contributions to the advancement of telecommunications and networking technologies. In addition to its telecommunications services, NTT is also involved in various other sectors, such as data centers, cybersecurity, cloud computing, and artificial intelligence. In 2022, there were 387 more patents issued to them while Osha Bergman Watanabe & Burton, Oblon, McClelland, Maier & Neustadt, and Harness IP are their three main law firms which they work the most for patent prosecution.

- Hyundai is one of the largest automobile manufacturers in the world based in South Korea. They invest significantly in research and development (R&D) to drive innovation and stay competitive in the industry. Furthermore, their focus on electric and autonomous vehicles may also have contributed to the increase in patents. They had a growth of 23.74% or 363 more patents in 2022 when compared to 2021. Morgan Lewis & Bockius, Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., and Crowell & Moring were their top law firms for patent prosecution

The full Patent Intelligence Report provides valuable statistics and information for anyone interested in understanding the patent landscape and identifying the leading players within the industry. It offers rankings of the top 100 companies, attorneys, and law firms based on their performance and activity across three categories: overall, high-tech, and biotech. In addition to these rankings, the report includes an accompanying Excel document that presents a detailed list of the top 2,000 most active companies, attorneys, and law firms, along with their corresponding metrics.

In the upcoming weeks, we plan to highlight the top attorneys and law firms featured in our previous Patent Litigation Report, including reviews provided by some of the corporate IP counsel and best-performing attorneys about other top attorneys. Stay tuned!